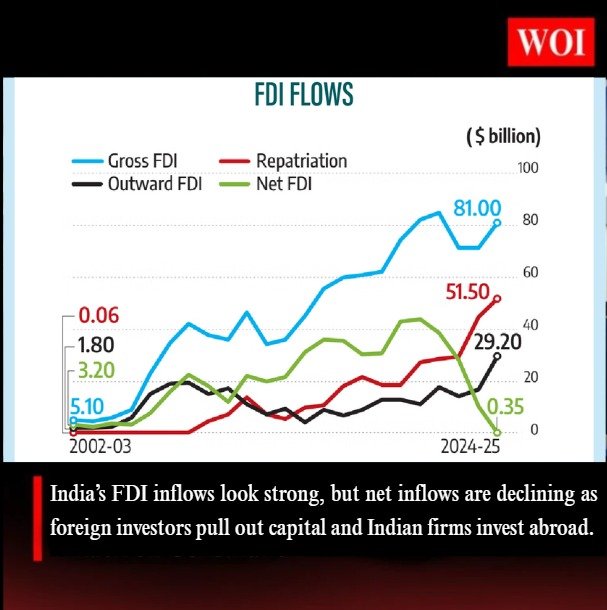

Foreign Direct Investment (FDI) continues to play a critical role in India’s growth story, but recent trends highlight a troubling imbalance. While gross FDI inflows touched $81 billion in FY 2024-25, net inflows fell drastically to just $0.4 billion, as disinvestments and repatriations surged.

Shifting Investor Behaviour

Once a hub for long-term industrial capital, India now sees FDI focused on short-term gains through financial services, energy, and hospitality. Manufacturing accounts for only 12% of inflows, weakening prospects for innovation and job creation.

Rising Outward Investments

Indian companies are investing more abroad, with outflows reaching $29.2 billion in FY 2024-25, citing regulatory hurdles, policy unpredictability, and infrastructure gaps. This drains domestic capital needed for sustainable growth.

Economic Implications

Falling net FDI threatens currency stability, balance of payments, and industrial development. With states like Maharashtra and Karnataka cornering most inflows in low-multiplier sectors, the benefits remain uneven.

The Way Forward

Experts stress the need for reforms to simplify regulations, ensure policy stability, and improve infrastructure. Aligning FDI with strategic sectors like advanced manufacturing and clean energy is key to strengthening resilience and sustaining growth.